Author : Khushi, a 2nd semester student at Maharshi Dayanand University, Rohtak

Abstract

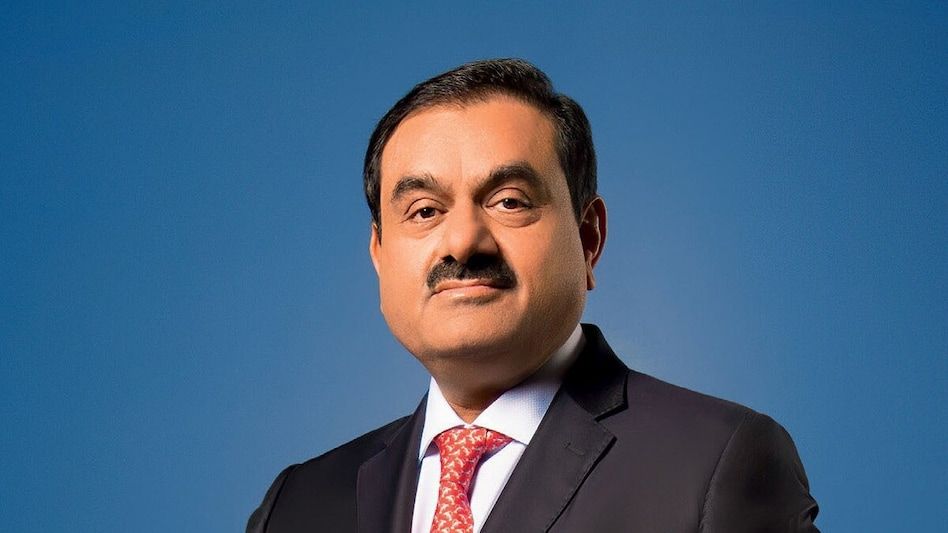

Gautam Adani is the chairman of the Indian conglomerate group and is the third richest person in the world but his rise has been accused of being built on a grand deception. The claim was made by a Hindenburg research report and when the news broke out 50 billion dollars were wiped out from the Adani wealth in just one day.

This is a story about a stock and accounting fraud and political favoritism that led an entrepreneur grow.

What is the Adani group?

Adani group is an Indian conglomerate which is headquartered in Ahmedabad, Gujarat. It was basically started by Gautam Adani in the year 1988 as a commodity-based business. Presently, the group runs 13 ports and operates seven airports with six coal fired power plants. They are the largest private player in the energy sector. The Adani group also a leading producer of solar panels. The top importer of edible oil and the largest supplier of gas to cities. They have even built their own private power lines. In recent years they branched out into Data Centers Financial services, Digital services ,real estate, cement and media. Thus, it is needless to tell that they do a lot of things. During their growth Adani group worked well with the Indian government, each gaining their own benefits.

Who is Hindenburg research who alleged Adani group of the scam?

Hindenburg Research is a company that investigates and exposes businesses they believe are engaged in fraud or unethical practices. They dig deep into financial documents and company actions to uncover any wrongdoing, then they publish their findings to inform investors and the public. They aim to hold companies accountable for their actions and protect investors from potential risks.

Hindenburg Research gained attention for its thorough investigations into various companies, uncovering alleged fraud or misconduct. Here are a few notable examples:

1. Nikola Corporation: Hindenburg Research published a report in 2020 accusing Nikola, an electric vehicle startup, of misleading investors about its technology and business prospects. They provided evidence suggesting that Nikola had exaggerated its technological capabilities and misrepresented its progress. This led to regulatory scrutiny and a significant drop in Nikola’s stock price.

2. Lords town Motors: Hindenburg Research released a report in 2021 alleging that Lords town Motors, an electric truck manufacturer, had misled investors about pre-orders for its vehicles and the state of its production facilities. The report raised concerns about the company’s transparency and business practices, contributing to a decline in its stock price and ongoing investigations by regulatory authorities.

3. Clover Health: Hindenburg Research published a report in 2021 accusing Clover Health, a Medicare Advantage insurer, of engaging in deceptive marketing practices and failing to disclose a Department of Justice investigation. The report raised questions about the company’s growth prospects and corporate governance, leading to increased scrutiny from investors and regulators.

These are just a few examples of Hindenburg Research’s investigations that have garnered attention for their impact on the companies involved and the broader investment community.

What was the alleged scam?

The Hindenburg report revealed a list of receipts that showed some suspicious transactions, undisclosed relationships and stuff that ultimately amounts to allegations of stock price manipulation and earnings manipulation.

The Adani group has 7 publicly traded companies and their stocks have increased by 819 percent over the past three years.

Hindenburg argued that the fundamentals for these companies don’t support the stock valuations. Many of these firms don’t generate consistent positive cash flows and the fact that the company used its own stock as collateral for some of its loans. Hindenburg believed that their sky-high valuations are the result of fraud and the report went into seven different parts to explain this belief:

The report explained about how there are offshore funds and shell companies with ties to Adani groups who own a significant company shares while their relationship is not disclosed publicly. Some of the funds have upwards of 99 percent of their money in Adani shares. The researchers highlight that these funds help control the stock’s price by carrying out trades that are not being highlighted as insider trading and make up a good number of stocks trading volume.

The Adani group has been caught up in multiple stock rigging scandals in the past. The 2007 ruling against the firm found that it had worked with a notorious stock manipulator , Ketan Parekh to bolster its price.

Even members of family, his younger brother, elder brother, his brother-in-law have been promoted to Executives within the Adani group despite having a history of being investigated for fraud repeatedly.

The report also brought to notice about the accounting manipulation and how the company lacks financial controls, how it potentially misappropriated taxpayer funds.

The report concluded with the Hindenburg research leaving 88 questions for the Adani group to clarify their view.

Adani group’s rebuttal

On 27 January, 2023 Adani group gave a reply to the Hindenburg report in which they tried justifying their acts by claiming that they have good credit ratings and how they meet various regulations as specified by the government.

The Adani group moreover alleged the Hindenburg research company saying that the timing of the report clearly shows a malafide intention to downgrade the company’s reputation and to downgrade the upcoming follow-on public offering from the Adani enterprise.

The Adani group again published a 413-page response in which they countered the Hindenburg report. They claimed that there has been selective and manipulative presentation in the public domain to set a false narrative.

Other allegations

There have also been significant allegations from the Indian parliament on Gautam Adani. It is alleged that the company has been favored several times by the government particularly during Prime minister Narendra Modi’s tenure. The topic has always been a subject of debate and scrutiny.

For instance, the government handed over six major airports to Adani Enterprises under controversial circumstances, allegedly breaching existing regulations and showing undue haste in completing the transactions. Critics argue this process displayed “gross irregularities” and “blind favoritism”. Additionally, Adani’s rapid business expansion in areas such as ports, power, and infrastructure coincide with favorable government policies and support.

Supporters of the Adani Group argue that they have successfully bid for projects through fair and transparent processes and have contributed to economic development and infrastructure improvement in India. However, concerns about the extent of their influence and potential conflicts of interest persist, leading to ongoing discussions and investigations.

Conclusion

The alleged Adani scandal, as exposed in the Hindenburg Report, represents a watershed moment for corporate governance and ethical conduct in India. While the Adani Group has denied the allegations, the revelations have cast a long shadow over its reputation and raised fundamental questions about transparency and accountability.

As stakeholders struggle with the fallout from the report, there is an urgent imperative to address the systemic issues it has exposed. Enhanced transparency, healthy regulatory oversight, and a renewed commitment to ethical business practices are essential to restoring trust and integrity in the corporate sector. Only through collective action and unwavering diligence can India’s business landscape truly emerge stronger and more resilient in the face of adversity.

FAQS

What is the Hindenburg Report?

ANS. The Hindenburg Report is an investigative research document compiled by Hindenburg Research, an independent financial analysis firm. It delves into allegations of impropriety and unethical practices within the Adani Group, a prominent Indian conglomerate.

What are the key allegations made in the Hindenburg Report against the Adani Group?

ANS. The report alleges various improprieties, including financial irregularities, governance concerns, environmental violations, and allegations of preferential treatment by government officials.

What financial irregularities are mentioned in the report?

ANS. The report highlights discrepancies in financial reporting by the Adani Group, suggesting potential manipulation and misrepresentation. It also raises concerns about governance lapses, such as board independence and executive oversight.

How does the report suggest the Adani Group benefited from government favouritism?

ANS. The report alleges close relationships between the Adani Group and government officials, with claims of preferential treatment, including favourable policies, subsidies, and regulatory exemptions.

Has the Adani Group responded to the allegations in the report?

ANS. Yes, the Adani Group has vehemently denied the allegations, asserting its commitment to ethical business practices and dismissing the report as baseless and malicious.

What steps are being taken to address the allegations and restore trust?

ANS. In response to the allegations, there have been calls for enhanced transparency, stricter regulatory oversight, and a renewed commitment to ethical conduct within the Adani Group and the broader business community.

What is the broader significance of the alleged scandal for India’s corporate landscape?

ANS. The alleged scandal underscores broader issues of corporate governance, accountability, and transparency in India’s business landscape. It serves as a wake-up call for reforms to ensure the integrity and credibility of the corporate sector.

References

Hindenburg research

National herald