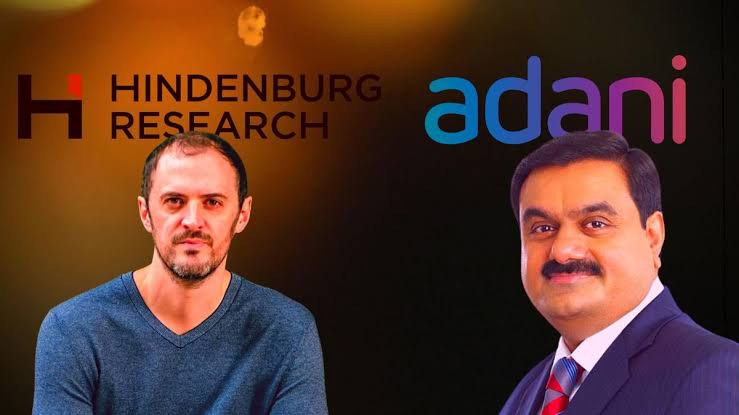

Unravelling the Adani Hindenburg Scandal: Navigating Between Half-Truths and Hard Realities

Author: Anish Parhi, a student at National Law University Odisha

Abstract:

- Enveloped within the dynamic landscape of corporate India, the Adani Hindenburg scandal emerges as a narrative marked by discreet makeovers, financial ingenuity, and a calculated adherence to legal frameworks. At its essence, this saga represents a meticulous orchestration where critical information is veiled, financial data undergoes manipulation akin to an intricate performance, and legal boundaries are delicately navigated to ensure compliance, if not always ethical propriety

.

- Consider this scenario as akin to a theatrical production. Behind the scenes, there is a deliberate effort to obscure pertinent details, echoing the meticulous concealment of a magician’s secrets. However, in this case, the hidden elements pertain not to magical tricks but rather to financial intricacies intentionally withheld from stakeholders, regulatory bodies, and the public.

- Moving to the financial realm, envision a masterful symphony wherein figures are not merely crunched but deftly manipulated to compose a narrative of prosperity. This process resembles the craftsmanship of a musical composition, each numerical element contributing to a harmonious melody that projects an illusion of financial well-being.

- In the legal domain, picture a carefully choreographed dance, with corporations executing precise moves to align with legal statutes while simultaneously testing the ethical boundaries. Legal jargon assumes the role of intricate dance steps, with terms such as “fiduciary duty” and “material information” guiding these movements in a nuanced choreography.

- Zoom out to the overarching stage of corporate India, where power dynamics, wealth accumulation, and influence become central themes shaping the narrative. Beyond the faceless façade of corporate entities, this is a nuanced realm where human decisions are propelled by aspirations for wealth, influence, and occasionally, the apprehension of failure.

- In the unfolding Adani Hindenburg drama, individuals and entities emerge as pivotal characters in this corporate theatre. Their motivations range from the pursuit of financial gain to the desire for influence. This narrative transcends the mere transactional aspects of finance; it delves into the human dimension, characterized by ambitions, aspirations, and the intricate decisions made in the relentless pursuit of success.

- The Adani Hindenburg scandal is not solely a financial puzzle; it is a narrative woven with human intricacies set against the backdrop of complex financial and legal stratagems. Unveiling its layers reveals a story not only of scandal but of the nuanced choices made within a realm where power, wealth, and influence converge.

Introduction:

- The realm of corporate finance has long been synonymous with opacity, a domain where companies strategically veil their financial machinations behind a fortress of intricate transactions and legal intricacies. This clandestine nature, however, faces an unprecedented challenge in the wake of the Adani Hindenburg scandal, an exposé that forcibly drags these manoeuvres from the shadows into the unforgiving glare of scrutiny. In doing so, it unfurls a narrative of deception so profound that its reverberations have sent seismic shockwaves through the very fabric of the business community.

- Traditionally, corporations have wielded the tools of complexity and legal ambiguity as shields, safeguarding their financial dealings from the prying eyes of stakeholders, competitors, and regulatory bodies. This opaque modus operandi has allowed them to navigate the intricate dance of profit and loss in relative obscurity, shielded by the language of legal jargon and convoluted financial transactions that often act as an impenetrable barrier to casual observers.

- However, the Adani Hindenburg scandal disrupts this established narrative. It is akin to a sudden exposure of the inner workings of a magician’s trick, revealing the mechanisms that were once hidden from view. The shockwaves it has generated are not merely confined to financial circles; they resonate across the broader business community, stirring conversations about the need for transparency and ethical conduct.

- This revelation is not merely a glimpse behind the corporate curtain; it is a seismic event that challenges the very foundations of the trust upon which the business world operates. Stakeholders, from investors to consumers, now find themselves grappling with a new reality—one where the intricate manoeuvres once obscured by legalese and financial complexity are laid bare, demanding a reassessment of the principles that underpin corporate governance.

- The fallout from the Adani Hindenburg scandal extends beyond individual corporate entities; it becomes emblematic of a broader discourse on corporate responsibility and accountability. The shockwaves act as a catalyst for discussions on regulatory reforms, ethical standards, and the imperative for heightened transparency. In essence, the scandal serves as a wake-up call, compelling the business community to confront the consequences of obscured financial dealings and prompting a collective introspection on the values that should guide corporate conduct in the modern era.

- In the aftermath of this revelation, the business landscape stands at a crossroads. The challenge lies not merely in addressing the specific transgressions of the Adani Hindenburg scandal but in fundamentally redefining the norms that govern corporate behaviour. The story it tells is not one of isolated deception but of a broader systemic need for reform—a call to dismantle the walls of secrecy and usher in an era where transparency and integrity form the cornerstone of corporate finance.

Legal Jargons:

- As we navigate through the tumultuous waters of the Adani Hindenburg scandal, the landscape shifts to a terrain dominated by legal subtleties, casting a spotlight on the intricate dance between legality and morality. In this unfolding drama, the canvas is painted with legal nuances, weaving a narrative that unravels the tapestry of corporate intrigue and machinations.

- The heart of the matter lies in the labyrinthine web of transactions, an intricate maze obscured by the dense foliage of legal jargon. This clandestine thicket not only shields the manoeuvres of corporate entities from the untrained eye but also introduces an element of opacity that blurs the line differentiating what is lawful from what is ethical. The result is a narrative where the once-distinct boundaries between legality and morality converge, creating a twilight zone where the very fabric of corporate conduct is called into question.

- Legal nuances, often wielded as tools for compliance and strategic advantage, become the paintbrushes with which the narrative is crafted. Terms such as “fiduciary duty,” “due diligence,” and “materiality” transform the discourse, shaping the contours of the story as it unfolds. It is in this semantic interplay that the subtleties of the Adani Hindenburg scandal manifest, exposing a realm where legal compliance, while ostensibly adhered to, dances perilously close to the ethical precipice.

- The blurred delineation between what is lawful and what is ethical introduces a moral complexity to the narrative, one that reverberates through boardrooms and courtrooms alike. As the saga unfolds, the audience is confronted with the disconcerting realization that adherence to the letter of the law may not necessarily equate to adherence to a higher ethical standard. The interplay of legal mechanisms, while ostensibly creating a shield of compliance, also becomes the very fog that obscures ethical considerations.

- In this intricate dance, the Adani Hindenburg scandal challenges not only legal frameworks but prompts a broader reflection on the ethical underpinnings of corporate conduct. It beckons stakeholders, from regulators to the general public, to scrutinize not just the legality of actions but also the moral compass guiding these actions. As the intricacies continue to unfurl, the narrative underscores the imperative for a recalibration—a realignment of corporate behaviour with ethical benchmarks to ensure that legality and morality walk hand in hand in the complex landscape of corporate governance.

The Proof:

- At the core of unraveling the Adani Hindenburg scandal lies a relentless pursuit of truth, where concrete evidence emerges as the sturdy backbone of this exposé. Imagine this evidence as a compass guiding the way through a dense forest of corporate complexities, meticulously obtained through exhaustive investigation and access to undisclosed documents.

- Picture a team of dedicated investigators, fueled by a commitment to uncover the hidden facets of corporate dealings. This trail of proof, though complex and shrouded in the intricacies of financial transactions, unveils a narrative that speaks volumes about the actions undertaken behind the scenes. It’s not merely a compilation of numbers but a storyline revealing financial discrepancies, dubious dealings, and the strategic exploitation of legal loopholes.

- In the labyrinth of documents and data, the evidence becomes a narrative thread, weaving together disparate elements into a cohesive story of corporate intrigue. It’s the smoking gun that speaks louder than words, forcing us to confront the uncomfortable truths that lie beneath the surface of financial reports and press releases.

- This exposé is not a mere exercise in finger-pointing; it’s a stark reminder of the significance of transparency in corporate dealings. The evidence becomes a mirror reflecting the consequences of opacity – a reminder that the absence of transparency can lead to a breeding ground for financial irregularities and questionable practices.

- The complexity of the evidence doesn’t detract from its human impact. It embodies the dedication of those who sift through financial intricacies to bring the truth to light. It represents a commitment to accountability, demanding that corporate entities operate in a manner that aligns with the principles of transparency and ethical responsibility.

- As we delve into the proof, it becomes apparent that the pursuit of truth is a collective effort, involving individuals who believe in the importance of holding corporate entities accountable for their actions. The evidence isn’t just a collection of data points; it’s a call to action, urging us to reevaluate the systems in place and advocate for a corporate landscape where transparency is not just a buzzword but a fundamental pillar upon which trust is built.

Case Laws:

- At the core of this legal exploration lies an acknowledgment of precedent-setting cases that have sculpted the landscape of corporate governance. One such landmark decision is the Enron scandal of the early 2000s. The fallout from Enron exposed the vulnerabilities in corporate oversight, leading to the Sarbanes-Oxley Act of 2002, a legislative response aimed at enhancing corporate accountability and financial transparency. Drawing parallels between the Adani Hindenburg scandal and Enron allows readers to recognize patterns of corporate misconduct and the subsequent legal measures invoked to rectify systemic flaws.

- The WorldCom scandal, another watershed moment in corporate history, is a relevant touchstone. The financial machinations and accounting irregularities at the heart of WorldCom resulted in significant losses for investors. The subsequent legal repercussions, including the conviction of top executives, underscore the imperative for legal scrutiny in cases of corporate malfeasance. By juxtaposing the Adani Hindenburg scandal with the WorldCom saga, the article encourages readers to discern recurrent themes and appreciate the legal mechanisms invoked to address corporate wrongdoing.

- Closer to home, the Satyam scandal in India serves as a pertinent reference point. The revelation of fraudulent financial statements by Satyam’s founder not only shook the foundations of corporate governance but also prompted regulatory reforms in India. By examining the legal fallout and regulatory changes triggered by Satyam, readers gain insights into how the legal landscape evolves in response to corporate scandals, setting the stage for understanding the legal implications of the Adani Hindenburg scandal.

- The article’s endeavour to provide a broader context extends to referencing the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in the United States. This legislation, born out of the financial crisis, aimed to enhance transparency, accountability, and oversight in the financial industry. As readers draw parallels between the Dodd-Frank Act and the legal ramifications of the Adani Hindenburg scandal, a narrative thread emerges, connecting historical events and legal responses to contemporary corporate malfeasance.

- In essence, the legal analysis becomes a lens through which the Adani Hindenburg scandal is examined, fostering a deeper appreciation for the legal intricacies surrounding such scandals. By drawing on the lessons of precedent-setting cases, readers are encouraged not only to scrutinize the specifics of the Adani Hindenburg affair but also to reflect on the broader legal evolution prompted by past corporate misdeeds.

Conclusion:

- As we come to the end of the Adani Hindenburg scandal saga, it transforms from a gripping narrative of corporate intrigue to a cautionary tale echoing through the corridors of both the business realm and the legal system. In this tale, the labyrinth of half-truths and deceptive practices unravels, revealing a stark reality: the delicate equilibrium between corporate triumph and ethical responsibility.

- The Adani Hindenburg scandal is not just a headline; it’s a mirror reflecting the fine line companies tread between success and ethical conduct. Picture a tightrope walk over a chasm where, on one side, lies the allure of financial prosperity, and on the other, the ethical abyss. The exposure of this scandal isn’t merely a revelation of wrongdoing; it’s a jarring reminder that, in the pursuit of success, the ethical fabric can be frayed, often to the detriment of trust, integrity, and the very foundations that underpin our economic systems.

- What unfolds is not just a demand for accountability from those implicated in the scandal, but a rallying cry for a broader introspection within the corporate landscape. It beckons leaders, decision-makers, and stakeholders to peer beyond profit margins and quarterly reports, urging them to evaluate the ethical compass guiding their actions. It’s a call to re-evaluate the fundamental principles that should govern corporate behaviour in a world increasingly interconnected and scrutinized.

- As we navigate the twists and turns of this scandal, the narrative becomes a powerful advocate for systemic reforms. It’s a plea for change in the way corporations operate, pushing for transparency, accountability, and a renewed commitment to ethical practices. This isn’t just about punitive measures for those directly involved; it’s a collective call to fortify the foundations of corporate governance, ensuring that they are resilient to the allure of shortcuts and the shadowy corners where ethical lapses might lurk.

- Think of it as a wake-up call for a corporate world that sometimes finds itself lost in the pursuit of profits. The Adani Hindenburg scandal isn’t an isolated incident but a symptom of a broader ailment that needs remedy. It’s a reminder that, just as trust is hard-earned, it can be shattered with a single revelation. This revelation, though unsettling, presents an opportunity for renewal—a chance for the corporate world to reaffirm its commitment not only to shareholders but to society at large.

- The Adani Hindenburg scandal isn’t just a chapter in corporate history; it’s a narrative that transcends boardrooms and courtrooms. It’s a human story of choices, consequences, and the imperative for change. As we close this chapter, the lessons learned become the guiding stars for a future where the delicate balance between corporate success and ethical responsibility is not just maintained but revered.

Sources:

The Adani-Hindenburg saga: A complete guide to what’s happened so far | Business News, The Indian Express Adani Group: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4445055

Impact of Hindenburg Research Report on the Stock Prices of Adani Group Companies: An Event Study: https://journals.sagepub.com/doi/abs/10.1177/2319510X231169338

India’s Oligarchic State Capitalism: https://online.ucpress.edu/currenthistory/article-abstract/122/843/123/195789/India-s-Oligarchic-State-Capitalism

Tax Heavens: Positive and Negative Consequences: